It?s that time again, when we take out our crystal ball and predict what will become of the Toronto real estate market in 2013. This time, we?re helped along with actual facts and figures from the CMHC (Canada Mortgage and Housing Corporation) Housing Outlook conference that we attended earlier this week.

In 140 characters or less, CMHC expects:

- A mild price correction isolated to certain areas of the market, followed by a rebound

- Balanced supply due to an increase in demand for rental condominiums and affordability

- New developments will continue to adjust to changing market conditions

- Investors will continue to remain a significant source of pre-construction housing

Read on for a look at the factors that affect Toronto?s real estate market and more stats and analysis than you probably want to read.

?

The Canadian Economy

The Toronto real estate market is directly related to the health of the Canadian economy, which in turn is impacted by the global economy. CMHC believes that most of the risks to our economy (and thus our real estate market) are around the financial cliff in the US (the upcoming end of tax breaks in the US coupled with the introduction of new taxes and spending cuts), the European situation (Europe is officially in recession once again) and the fact that emerging markets are growing more slowly. Ontario?s economy is most tightly related to the American economy, which means that we?re most directly impacted by what?s happening in the US and are largely sheltered from Europe?s problems.?

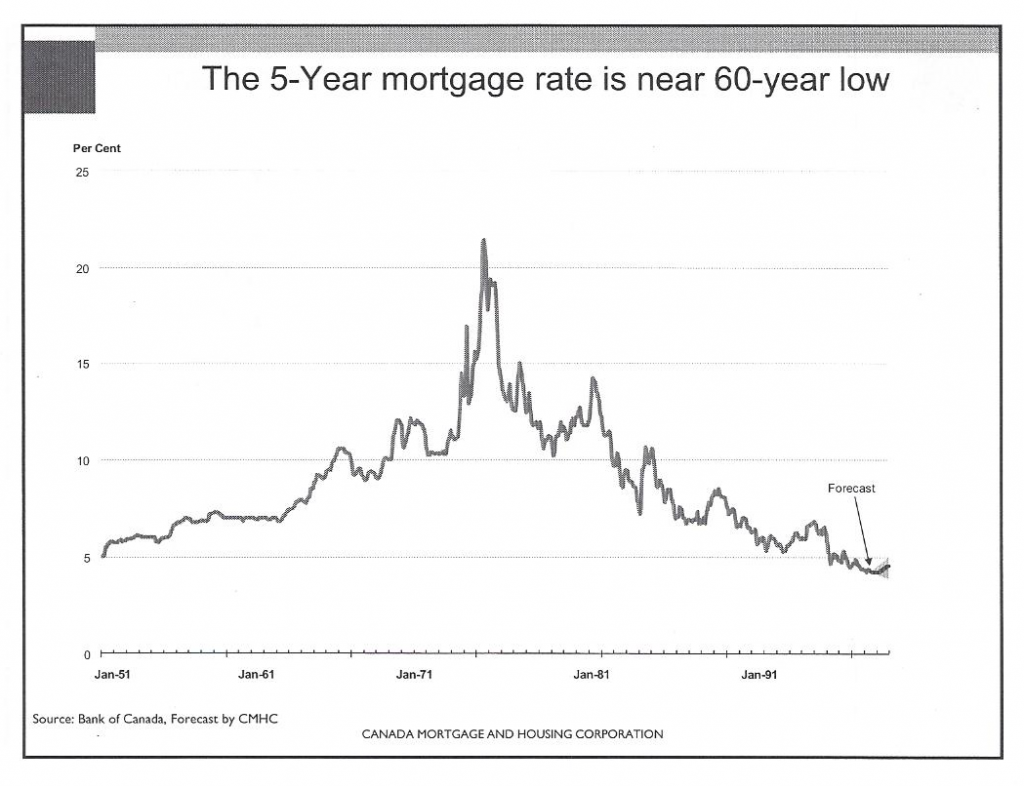

Nobody loves the fact that Canadians continue to pile on household debt, making Canada more vulnerable to economic shock. Interest rates are predicted to continue to be at or near current 60-year lows.?

?

Good ?Ol Supply and Demand

The current inventory of resale condos in Toronto represents a 4.5 month of supply, which means that technically, we are almost in a buyer?s market. CMHC isn?t particularly concerned with the current inventory of properties in Toronto ? the real risk is whether or not builders respond to slowing demand (the BREL take: we?ve already been seeing this happening, with fewer new condominium launches and delayed projects).?

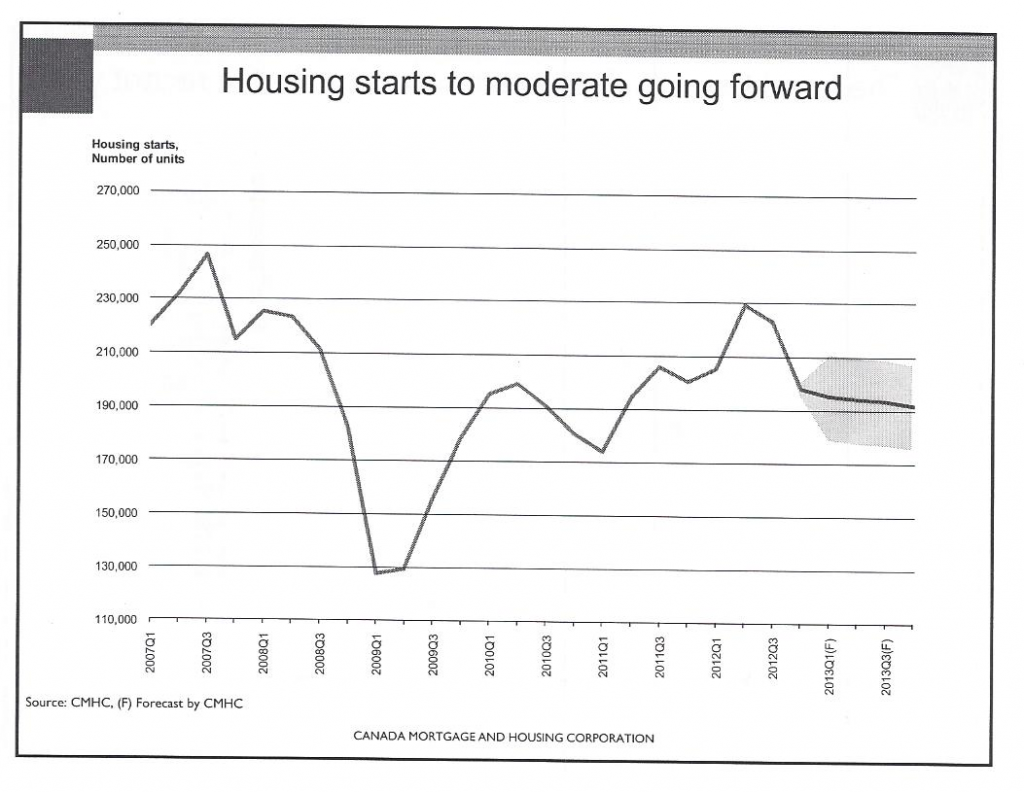

One need only look at the number of cranes in Toronto to know that there are a lot of condos being built downtown. ?CMHC is expecting the number of housing starts to moderate; in other words, there will be fewer new homes constructed in 2013. Condos currently under construction represent 30% of the existing stock, however only 5% of them remain unsold when the buildings are complete, so there won?t suddenly be tens of thousands of unsold condos on the market. New developments slated to be completed in 2013 will represent a 5% growth in resale stock ? still below the average in Toronto.

CMHC believes that strong demand to live downtown Toronto coupled with demand from investors wanting rental units will support the supply in the condo market. There was however some concern about new condos being built outside of Toronto?s core which have lower demand and command lower rents (and thus investor interest).

The BREL take: Remember: A balanced market isn?t a bad thing ? it means more choices for buyers and a balance of power at the negotiating table.

?

Are prices headed down?

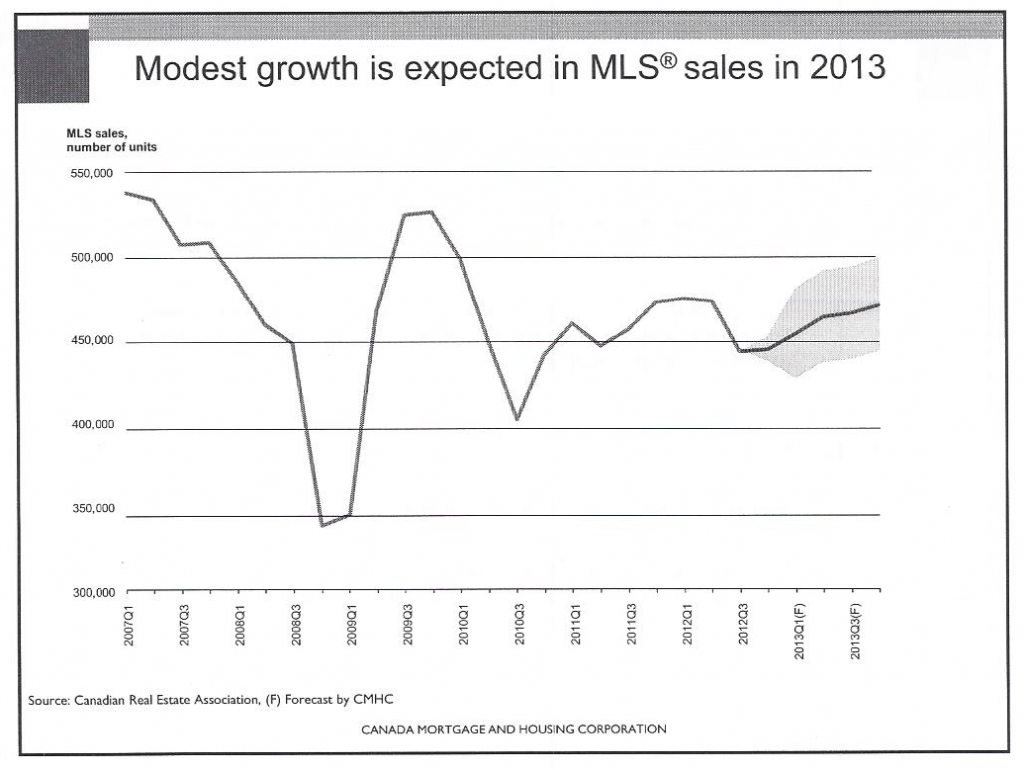

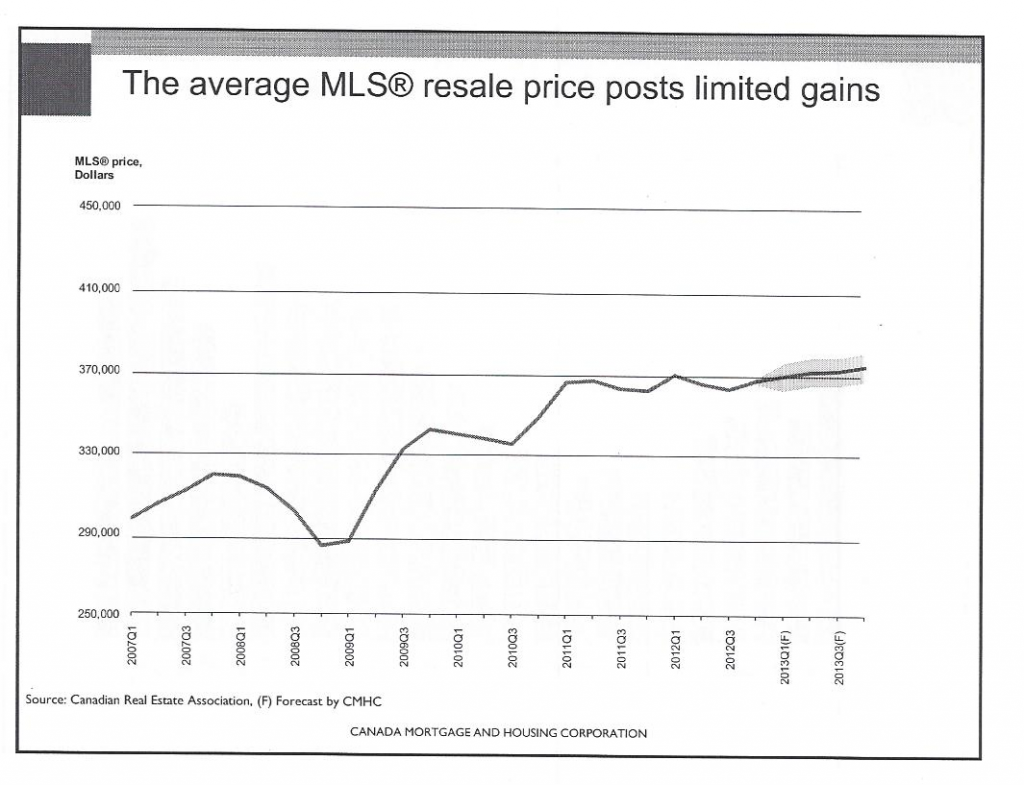

CMHC predicts limited price growth in the resale market (meaning prices are expected to be flat). They also predict modest growth in the number of MLS sales in 2013. Specifically with respect to condos, they recognize that the condo market is slowing but expect it will stabilize in the near term Any dip in prices in 2013 is expected to be minor and quickly rebound.

The BREL take: While bidding wars and double-digit growth were fun for a while, we all knew that it wasn?t sustainable. The last thing homeowners in Toronto (and yes, real estate agents) want is a housing crash. I?ll take a period of flat growth and government regulation to slow down the market if it means our longer-term prospects are more stable.

?

A Word about Condos

Yes, Toronto has a lot of condos, but that trend is seen round the world as cities are densifying. As house prices continue to appreciate faster than condos, affordability will increasingly drive people to buy condos, which of course are also the primary draw for most first-time home buyers. Condos are also ideal for our changing demographics ? 51% of households in Toronto now house 2 people or less.

Twenty two percent of condos are currently used as rentals (thus easing the supply pressures) and with rental vacancies in Toronto at all-time lows, condos are helping fill the need for rental accommodation (hardly no one builds rental buildings anymore). Of the 35,000 new households in Toronto every year, 10,000 of them rent.

?

Immigration is Good

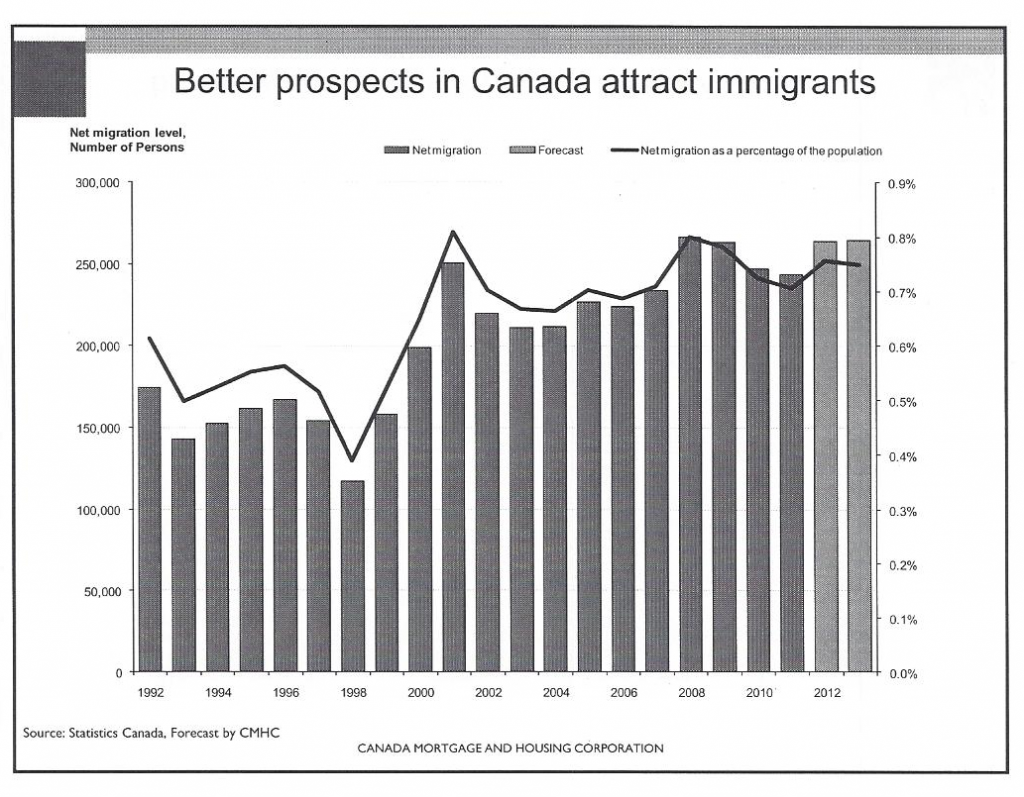

Canada continues to offer great prospects to immigrants and immigration is forecasted to rise in 2013. Immigration is a double support to housing ? when people first arrive to Toronto, they tend to be renters (thus supporting the investor condo market), and a large percent of immigrants end up buying a home.

?

Investors aren?t Going Anywhere

In the last 12 months, 14,000 new condos were registered. It?s estimated that half of pre-construction purchasers are investors (Canadian and foreign). While we used to see many speculative investors buying new condos and flipping them for profit, that trend has been changing (partly because new construction and resale prices are aligning, and partly because the federal government is closing a tax loophole that flippers used to enjoy). Investors are increasingly renting their units (vs selling them on completion) as Toronto?s rental market is strong and investors can cover their costs with rent (and still get a 5.5% cap rate). CMHC expects to see continued investment from long-term condo investors.

?

Foreign Investors

There?s always talk (and concern) about foreign money in Toronto?s real estate market, mostly because there isn?t a great way of tracking if. How many condos are owned by non-Canadians? What if all the foreign investors just up and left one day, flooding the market with condos for sale?

Good news: CMHC isn?t particularly worried about an exodus of foreign money. In an attempt to figure out how many condos are actually owned by non-Canadians, CMHC worked with MPAC and determined the residency of owners of newly registered properties. They determined that 3.7% of condo owners have primary addresses not in Canada (though some of these are probably residents living abroad). Coupled with the fact that housing in Toronto still remains affordable when compared to some of the world?s other big cities and a strong Canadian economy (certainly compared to other G7 countries), Toronto is expected to remain an attractive place for foreign investment.

?

So there you have it ? the CMHC predictions for Toronto?s real estate market. As always, we?d love to hear your thoughts?what do you predict will happen in 2013??

?

best picture 2012 oscar winners channel 3 news j lo j lo sacha baron cohen ryan seacrest octavia spencer

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন